AdaptiveTrend provides 13 distinct signal types, each designed for specific market conditions. They're organized by priority—higher priority signals fire first.

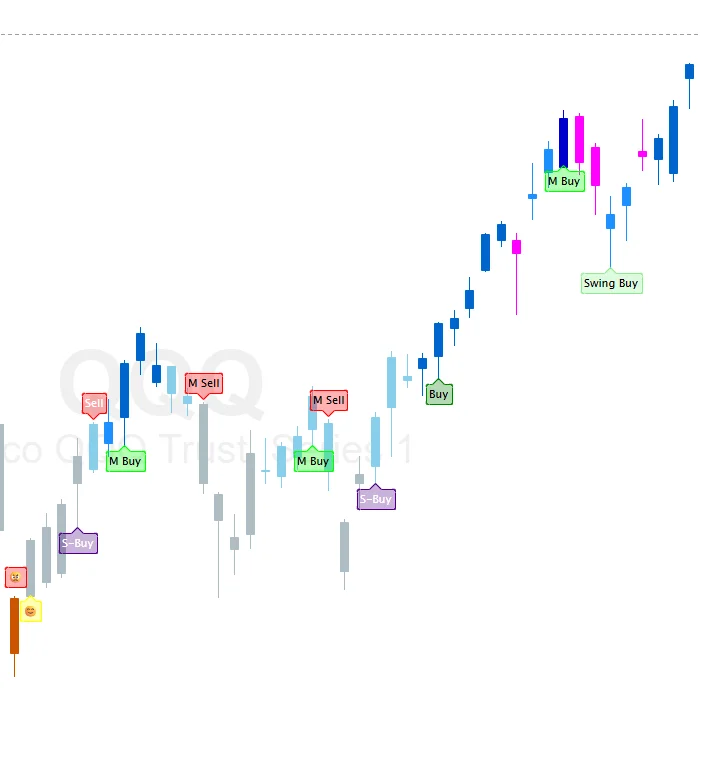

1. Stealth Buy (S-Buy)

Priority 1 - Buy Signal

Catches quiet accumulation before momentum indicators confirm. The ultimate early-entry signal.

When it fires:

3 consecutive grey (neutral) candles, each making a higher high. Current bar can be grey or bullish.

Use for:

• Catching moves before the crowd

• Low-risk entries in consolidation

• Building positions early

1. Stealth Sell (S-Sell)

Priority 1 - Sell Signal

Catches quiet distribution before breakdown. Exit before the crowd panics.

When it fires:

3 consecutive grey candles, each making a lower low. Current bar can be grey or bearish.

Use for:

• Early warning of weakness

• Taking profits before breakdown

• Tightening stops

2. Primary Buy

Priority 2 - Buy Signal

Major trend change signal. The classic "new uptrend starting" indicator.

When it fires:

Fast KAMA crosses above slow KAMA (golden cross).

Use for:

• Catching major trend changes

• Position trading entries

• High-conviction setups

2. Primary Sell

Priority 2 - Sell Signal

Major trend change to downside. The "new downtrend starting" signal.

When it fires:

Fast KAMA crosses below slow KAMA (death cross).

Use for:

• Exiting long positions

• Short entry opportunities

• Avoiding drawdowns

3. Happy Face (😊)

Priority 3 - Buy Signal

Explosive bullish breakout with gap up. Panic buying in progress.

When it fires:

Price gaps up from below both MAs to above both MAs.

Use for:

• Explosive breakout plays

• Gap-up momentum

• High-volatility entries

3. Angry Face (😠)

Priority 3 - Sell Signal

Explosive bearish breakdown with gap down. Panic selling in progress.

When it fires:

Price gaps down from above both MAs to below both MAs.

Use for:

• Quick exits

• Avoiding breakdowns

• Short opportunities

4. Swing Buy

Priority 4 - Buy Signal

Gradient color flip from bearish/neutral to bullish with KAMA32 confirmation.

When it fires:

2 bars bearish/neutral, current bar bullish, close above KAMA32.

Use for:

• Swing trade entries

• Multi-day holds

• Catching trend shifts

4. Swing Sell

Priority 4 - Sell Signal

Gradient color flip from bullish/neutral to bearish with KAMA32 confirmation.

When it fires:

2 bars bullish/neutral, current bar bearish, close below KAMA32.

Use for:

• Swing trade exits

• Trend reversal detection

• Taking profits

5. Momentum Buy (M Buy)

Priority 5 - Buy Signal

Acceleration within weak uptrends. 4-pattern system catches explosive moves.

When it fires:

2 bars weak/moderate bullish + one of 4 patterns:

• Simple higher high (most common)

• V-bottom with gap

• Engulfing after lower low

• Reversal candles (hammer, doji, etc.)

Use for:

• Acceleration plays

• Adding to positions

• Momentum breakouts

5. Momentum Sell (M Sell)

Priority 5 - Sell Signal

Momentum failure in weak uptrends. Warning of reversal.

When it fires:

2 bars weak/moderate bullish + one of 4 patterns:

• Simple lower low (momentum failure)

• V-top with gap

• Bearish engulfing

• Inverted hammer

Use for:

• Exiting weak trends

• Tightening stops

• Reversal warning

6. Reversal Buy (3R Buy)

Priority 6 - Buy Signal

Classic reversal patterns from bearish to bullish. High-probability setups.

When it fires:

2 bars bearish/neutral + reversal pattern + close above KAMA Long:

• V-bottom with gap up

• Engulfing after lower low

• Hammer, doji, marubozu patterns

Use for:

• Catching bottoms

• Reversal trading

• V-shaped recoveries

6. Reversal Sell (3R Sell)

Priority 6 - Sell Signal

Classic reversal patterns from bullish to bearish.

When it fires:

2 bars bullish/neutral + reversal pattern + close below KAMA Long:

• V-top with gap down

• Engulfing after higher high

• Inverted hammer pattern

Use for:

• Catching tops

• Reversal exits

• Short setups

7. Continuation Buy (C Buy)

Priority 7 - Buy Signal

Buy the dip in established uptrends. Pullback entry specialist.

When it fires:

In uptrend (fast MA > slow MA), price dips below fast MA but stays above slow MA, then reclaims fast MA.

Use for:

• Buying dips

• Adding to winners

• Low-risk trend entries

7. Continuation Sell (C Sell)

Priority 7 - Sell Signal

Sell the bounce in established downtrends.

When it fires:

In downtrend (fast MA < slow MA), price bounces above fast MA but stays below slow MA, then rejects back down.

Use for:

• Selling bounces

• Short entries in downtrends

• Taking profits on rallies