🎓 TrendCatcher User Guide

🚀 Getting Started

Installation

- Purchase TrendCatcher from the TrendSpider marketplace

- Open TrendSpider and navigate to your chart

- Click "Indicators" → "My Indicators" → "TrendCatcher"

- The indicator will load with default settings (ready to trade!)

First Look

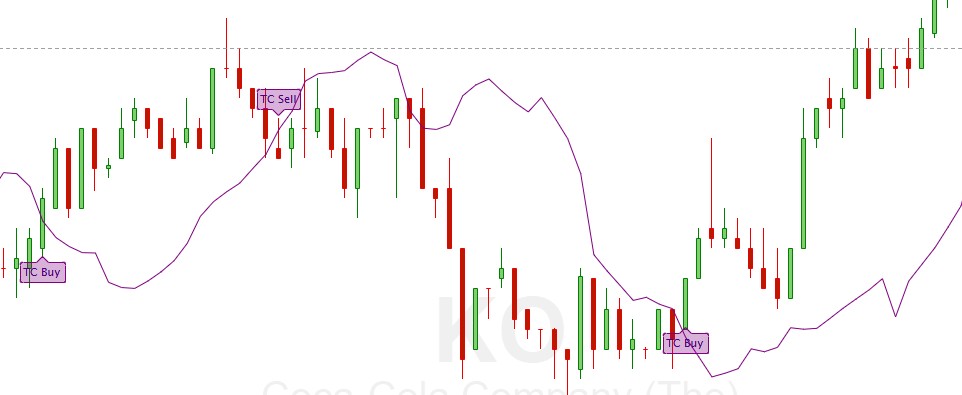

When TrendCatcher loads, you'll see:

- Purple "TC Buy" labels below candles where uptrend reversals are detected

- Purple "TC Sell" labels above candles where downtrend reversals are detected

- Optional purple trend line showing the volume-weighted regression (toggle on/off)

That's it. No complicated overlays. No confusing colors. Just clear buy and sell signals when trends are about to reverse.

💡 Quick Win

The default settings work great out of the box. Most traders never need to adjust anything. But if you want to customize, keep reading.

⚙️ Understanding Your Settings

Trading Style: Your Speed Dial

This is the single most important setting. It controls how fast or conservative TrendCatcher behaves.

| Mode |

Best For |

Signal Frequency |

Quality |

| Aggressive |

Day trading, scalping, fast-paced markets |

High (more signals) |

Good (some noise) |

| Normal (Default) |

Swing trading, active investing |

Medium (balanced) |

Very Good (proven) |

| Conservative |

Position trading, slow markets |

Low (fewer signals) |

Excellent (highest quality) |

How to choose: Start with Normal. If signals feel too slow, switch to Aggressive. If too noisy, switch to Conservative.

ATR Multiplier: Your Sensitivity Control

This setting determines how far price must move beyond the TrendCatcher line to trigger a signal. It's CRITICAL for filtering noise vs. catching moves.

Understanding ATR Multiplier

0.1-0.3 (Aggressive)

Ultra-sensitive. Catches moves early. If ATR = $2, price only needs to move $0.20-0.60 past the line.

Use when: Day trading, trending markets, you want maximum signals

0.5 (Normal - Default)

Balanced sweet spot. If ATR = $2, price must move $1.00 past the line.

Use when: Swing trading, most market conditions, you want quality and quantity

0.6-1.0 (Conservative)

Requires significant movement. If ATR = $2, price must move $1.20-2.00 past the line.

Use when: Position trading, choppy/volatile markets, you want only the best signals

Simple rule: Lower ATR = hair trigger (trending markets). Higher ATR = confirmation required (choppy markets).

Regression Mode: Your Directional Bias

TrendCatcher can be optimized for the direction you trade.

- Balanced (Default): No bias. Catches both long and short setups equally. Best for most traders who trade both directions.

- Long Mode: Optimized for uptrends. Focuses on support levels. Generates more BUY signals, filters SELL signals more strictly. Use if you only trade long or have a bullish bias.

- Short Mode: Optimized for downtrends. Focuses on resistance levels. Generates more SELL signals, filters BUY signals more strictly. Use if you only short or have a bearish bias.

Why it matters: If you're a long-only trader using Short mode, you'll miss opportunities and get signals you won't take. Match the mode to your strategy.

Signal Cooldown: Your Frequency Control

Prevents signal clustering and overtrading by spacing signals apart.

| Cooldown |

Spacing |

Best For |

| 0-2 bars |

Minimal (max signals) |

Scalping, very active trading |

| 4 bars (Default) |

Balanced (60 min on 15-min charts) |

Most trading styles |

| 6-10 bars |

Wide (highest quality) |

Position trading, patient traders |

Example: On 15-minute charts with 4-bar cooldown, after a signal fires, the next signal can't appear for at least 60 minutes (4 × 15 min).

Visual Options

- Show Buy Signals: Toggle purple TC Buy labels on/off

- Show Sell Signals: Toggle purple TC Sell labels on/off

- Show TrendCatcher Line: Toggle the underlying volume-weighted regression line (off by default for cleaner charts)

📖 How to Read TrendCatcher Signals

TC Buy Signal

A purple "TC Buy" label appears below a candle when:

- Price crosses ABOVE the TrendCatcher line + ATR buffer

- Volume ratio exceeds the threshold (institutional backing)

- Cooldown period has passed since last signal

What it means: The trend is reversing to the upside with volume confirmation. This is your cue to consider a long entry.

What it doesn't mean: It's not a guarantee. It's a high-probability setup that you should evaluate alongside your own analysis, risk management, and trading plan.

TC Sell Signal

A purple "TC Sell" label appears above a candle when:

- Price crosses BELOW the TrendCatcher line - ATR buffer

- Volume ratio exceeds the threshold (institutional backing)

- Cooldown period has passed since last signal

What it means: The trend is reversing to the downside with volume confirmation. This is your cue to consider a short entry or exit long positions.

The TrendCatcher Line (Optional)

If you enable "Show TrendCatcher Line", you'll see a purple line on your chart. This line represents the volume-weighted linear regression - essentially where price "should" be based on recent volume-weighted price action.

How to use it:

- When price is below the line, bias is bearish

- When price is above the line, bias is bullish

- The steeper the line, the stronger the trend

- When price hugs the line, the trend is mature (be cautious)

Most traders keep this line OFF for cleaner charts and just use the signals.

⚠️ What TrendCatcher Is NOT

TrendCatcher is not a magic button. It doesn't predict the future. It doesn't work 100% of the time (nothing does). It's a tool that identifies high-probability trend reversal setups based on volume-weighted price action and adaptive volatility analysis.

Your job as a trader is to:

- Use TrendCatcher signals as part of a complete trading plan

- Apply proper risk management (stop losses, position sizing)

- Consider market context (support/resistance, news, market hours)

- Track your results and optimize settings for YOUR style

💰 Proven Trading Strategies

Here are four battle-tested strategies using TrendCatcher. Pick the one that matches your trading style and timeframe.

Strategy 1: The Scalper (1-5 Minute Charts)

Settings:

- Trading Style: Aggressive

- ATR Multiplier: 0.3

- Cooldown: 1-2 bars

- Regression Mode: Balanced

Entry Rules:

- TC Buy signal fires on 1-min or 5-min chart

- Enter immediately on the close or next open

- Target: 0.5-1% profit or until TC Sell fires

Stop Loss: Below the signal bar low (tight, 0.3-0.5%)

Best for: Active traders who can watch the screen, liquid instruments with tight spreads

Strategy 2: The Day Trader (15-Minute Charts)

Settings:

- Trading Style: Normal

- ATR Multiplier: 0.5

- Cooldown: 4 bars (default)

- Regression Mode: Balanced or Long (if long-only)

Entry Rules:

- TC Buy signal fires on 15-min chart

- Check 1-hour chart for trend confirmation (price above major moving average)

- Enter on next candle open or pullback

- Target: 1-3% profit or until TC Sell fires

Stop Loss: Below the signal bar low or recent swing low (1-2%)

Best for: Day traders seeking 1-3 quality setups per day

Strategy 3: The Swing Trader (1-Hour or Daily Charts)

Settings:

- Trading Style: Normal

- ATR Multiplier: 0.5

- Cooldown: 5-6 bars

- Regression Mode: Long (if long bias) or Balanced

Entry Rules:

- TC Buy signal fires on daily chart

- Confirm signal aligns with major support or key level

- Enter on next day's open or wait for pullback on 1-hour chart

- Target: 5-15% profit or until TC Sell fires

Stop Loss: Below signal bar low or major support level (2-5%)

Best for: Swing traders holding 3-10 days per trade

Strategy 4: The Position Trader (Daily or Weekly Charts)

Settings:

- Trading Style: Conservative

- ATR Multiplier: 0.7

- Cooldown: 8-10 bars

- Regression Mode: Long (for stocks) or Balanced

Entry Rules:

- TC Buy signal fires on daily or weekly chart

- Confirm fundamental backdrop is positive (earnings, sector strength)

- Enter within 1-3 days of signal

- Target: 20%+ profit or until TC Sell fires

Stop Loss: Below signal bar low or major support (5-10%)

Best for: Patient traders seeking major trend reversals for months-long holds

📊 Strategy Performance Tips

Win Rate Expectations:

- Aggressive settings: 50-60% win rate (more signals, some noise)

- Normal settings: 60-70% win rate (balanced)

- Conservative settings: 70-80% win rate (fewer, higher quality)

Remember: Win rate doesn't matter as much as risk/reward. A 50% win rate with 2:1 R:R is profitable. A 70% win rate with 1:1 R:R is better.

❓ Frequently Asked Questions

Does TrendCatcher repaint?

No. Signals lock in at bar close and never change. What you see in real-time is what stays on the chart.

What timeframe works best?

TrendCatcher is optimized for 15-minute charts but works on all timeframes from 1-minute to weekly. Start with 15-minute and experiment from there.

Can I use TrendCatcher on crypto/forex/futures?

Yes! TrendCatcher works on any liquid market with volume data. Many traders use it successfully on crypto (BTC, ETH), forex pairs (EUR/USD, GBP/USD), and futures (ES, NQ).

How many signals should I expect per day?

It depends on your settings and timeframe. On 15-minute charts with Normal settings, expect 2-5 signals per day per symbol. With Aggressive settings, expect 5-10 signals. With Conservative, expect 1-3 signals.

Should I use Long, Short, or Balanced mode?

Use Balanced if you trade both directions. Use Long mode if you only go long (buy) or have a bullish bias. Use Short mode if you only short sell or have a bearish bias. Balanced is best for most traders.

What's the best ATR multiplier setting?

Start with 0.5 (default). If you're missing good setups, lower it to 0.3-0.4. If you're getting too many false signals, raise it to 0.6-0.7. Match it to current market conditions.

Can I use TrendCatcher with other indicators?

Absolutely! TrendCatcher works great alongside RSI (overbought/oversold confirmation), moving averages (trend filter), support/resistance levels, and volume indicators. Just avoid indicator overload - 2-3 total is plenty.

💎 Pro Tips from Expert Traders

Tip #1: Confluence Is King

Don't take signals in isolation. Look for confluence: TC Buy + bouncing off support + RSI oversold = high-probability setup. Multiple confirmations = higher win rate.

Tip #2: Use Multiple Timeframes

Check the higher timeframe for trend direction. A TC Buy on the 15-min chart is stronger when the 1-hour or daily chart shows an uptrend. Trade with the higher timeframe trend, not against it.

Tip #3: Respect the First Hour

For day trading, the first 30-60 minutes of the market open can be choppy and produce false signals. Consider waiting until 10:00-10:30 AM ET for cleaner signals, or use Conservative settings during the open.

Tip #4: Scale Into Winners

Instead of going all-in on the first signal, enter 50% position. If the trade moves in your favor and another TC Buy fires (or you get confirmation from price action), add the remaining 50%. This reduces risk on losers while maximizing winners.

Tip #5: Journal Everything

Keep a trading journal with screenshots of every TrendCatcher signal you take. Note the timeframe, settings, outcome, and what you learned. After 50-100 trades, patterns will emerge showing you YOUR personal edge with TrendCatcher.

📞 Support & Resources

You're not alone. We're here to help you succeed with TrendCatcher.

- Documentation: This guide covers everything you need to know

- Video Tutorials: Watch step-by-step setup and strategy videos

- Email Support: support@trendpulseindicators.com - We respond within 24 hours

- TrendSpider Community: Connect with other TrendCatcher users

- Free Updates: Lifetime improvements and enhancements at no cost

Feedback: We're constantly improving TrendCatcher based on user feedback. If you have suggestions, feature requests, or questions, reach out. Your input shapes the future of this indicator.

🎓 Your Success Is Our Success

TrendCatcher is more than an indicator - it's a complete trend detection system backed by ongoing support, education, and community. We're committed to helping you become a better, more profitable trader.